CERTIFIED PROFESSIONALS

IN 150 COUNTRIES

Choose the Cybersecurity Training That Fits Your Career Goals

Empowering Professionals to Reach Their Cybersecurity Career Goals

Enterprise Offerings

At EC-Council, cybersecurity education is not mere knowledge transfer but the use of proven methods in all aspects of training– from content development to hands-on skill-development in labs to a proctored exam for certification.

Our trainings delves deep into the learning requirements of cybersecurity professionals worldwide to identify the challenges they face on job

Enterprise Offerings

At EC-Council, cybersecurity education is not mere knowledge transfer but the use of proven methods in all aspects of training– from content development to hands-on skill-development in labs to a proctored exam for certification.

Our trainings delves deep into the learning requirements of cybersecurity professionals worldwide to identify the challenges they face on job

Cybersecurity Career Track

Vulnerability assessment and penetration testing (VAPT)

VAPT is a technique to protect an organization against external and internal threats by identifying security threats.

Network Defense and Operation

Network security covers many technologies, devices, and processes. It refers to a set of rules and configurations designed to protect the integrity, confidentiality, and accessibility of computer networks and data.

Forensics

Digital forensic science is a branch of forensic science that focuses on recovering and investigating material found in digital devices related to cybercrime. Digital forensics is identifying, preserving, analyzing, and documenting digital evidence.

Incident Handling and Response

Cybersecurity professionals pursuing incident handling and response as a career require comprehensive training on Incident Handling and Response (IH&R) concepts and real-world scenarios. To help you build a career in Incident Handling and Response, we have…

Network Defense and Operation

Network security covers many technologies, devices, and processes. It refers to a set of rules and configurations designed to protect the integrity, confidentiality, and accessibility of computer networks and data. Network security consists of hardware and software..

Digital Forensic

Digital forensic science is a branch of forensic science that focuses on recovering and investigating material found in digital devices related to cybercrime. Digital forensics is identifying, preserving, analyzing, and documenting digital evidence…

Application Security

Application security is the process of deploying steps and protocols by organizations and developers to identify, repair, and protect applications against security weaknesses throughout the application life cycle. Furthermore, it is used to describe security measures at the application level..

Application Security

Application security is the process of deploying steps and protocols by organizations and developers to identify, repair, and protect applications against security weaknesses throughout the application life cycle. Furthermore, it is used to describe security measures at the application level.

Incident Handling and Response

Cybersecurity professionals pursuing incident handling and response as a career require comprehensive training on Incident Handling and Response (IH&R) concepts and real-world scenarios.

Choose Your Career Path

The choice of a career pathway is more challenging than ever due to the ever-changing career landscape. At EC-Council, we offer both professional certifications and career tracks.

Learners are guided to set clear objectives on where to get to and how to get, and succeed

Vulnerability assessment and penetration testing (VAPT)

VAPT is a technique to protect an organization against external and internal threats by identifying security threats.

Choose Your Career Path

The choice of a career pathway is more challenging than ever due to the ever-changing career landscape. At EC-Council, we offer both professional certifications and career tracks.

Learners are guided to set clear objectives on where to get to and how to get, and succeed

Trusted Worldwide

- 1 in Every 2 Professionals Received Promotions After C|EH.

- 97% Of Professionals Found C|EH Labs to Accurately Mimic Real-World Cyber Threats.

- 97% Of Professionals Stated That Skills Acquired In C|EH Helped Safeguard Their Organizations.

- 95% Chose C|EH for Career Growth.

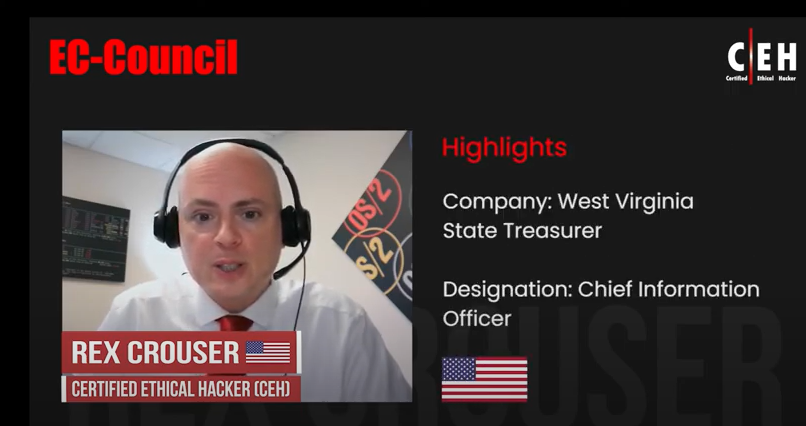

Reviews

Iskren-yankon

Chief Expert Information Security Officer

Seth Henry

System Engineer